Fiona Teng 鄧穎恆 (she / her) is a Hong Kong-born, SF Bay Area-made, and NYC-based equity-informed communications strategist, writer, and storyteller. She has over 15 years of experience working cross-departmentally to strategize, manage, and develop stories and content for print and digital media.

Her approach to poignant, succinct, and engaging storytelling is motivated by both her knack for spotting unique perspectives and connecting with the reader. Whether she’s creating content from her perspective or someone else’s, Fiona’s ability to engage with her audience personally creates an emotionally and intellectually compelling experience.

Some professional highlights include:

- Leading editorial content development and project management at Thousand Currents, for initiatives including annual report, year-end appeal, monthly newsletters, stories, website updates, and more;

- Conducting communications audit of the Rockefeller Brothers Fund external communications, culminating to a full report;

- Directing the visual identity and digital promotions for The Light Ahead podcast;

- Supporting research, editing, and promotions for the book Beloved Economies: Transforming How We Work;

- Leading the writing for Building Movement Project’s race equity assessment, report, and website;

- Assessing the communications landscape at the Northeast Sustainable Agriculture Working Group, and creating a comprehensive communications report with observations and recommendations (see report below);

- Leading the NYU Entrepreneur Institute‘s website accessibility retrofit, while helping them articulate their user journey; and

- Creating a Zipcar campaign video with over 280,000 views.

She’s written several nonfiction essays, including a cultural, political, and personal exploration of her home of Hong Kong; a reflection on decolonizing her name, and a call for Afro-Asian solidarity. She’s very proud to have been a strong advocate for student loan reform, sharing her experience at a U.S. Senate press conference and on Al Jazeera America.

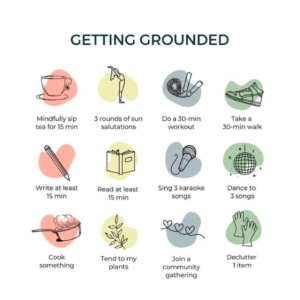

Fiona serves as a founding member of the Alumni of Color Association at her alma mater, UCSB’s Bren School of Environmental Science and Management, to drive institutional and programmatic refocus with equity at the center. She loves creating content for her project The Way Out, organizing with Asians 4 Palestine, and playing percussion at protests. She is working on a fictionalized telling of her family’s story.

What People Say

Samples of Work

- Thousand Currents’ 2024 Annual Report

- Thousand Currents’ year-end appeal samples here, here, and here

- Thousand Currents’ monthly newsletters here and here

- Building Blocks for Change’s website and program descriptions

- Somatics of Money’s program descriptions

- People Power’s Spotlight series

- Beloved Economies’ The Light Ahead podcast

- Columbia University’s Center for Justice Website

- Additional materials available upon request

- The Immutable Fight for a Free Hong Kong

“What is most remarkable to me is that people fight no matter what. They tell their own stories, hack state policies, outsmart the police. They are fluid, they are clever, they protect one another. They throw stones, slingshots, molotov cocktails. They make art, sing songs, they dance and celebrate, despite horror. They will make you listen, they are everywhere.” - Call Me By My Names: A Story of Shame, Trauma, and Liberation in a Chinese Name

“The stillness in the gym contradicted my pounding heart. My breath quickened and my folded hands tightened as I admitted to the group, ‘This is the first time I’ve ever introduced myself with both of my names.’ The gym erupted into applause and cheers, tangling in my throat a knot of emotions that rendered me speechless.” - Our Time is Now: The Case for and Imperative of Afro-Asian Solidarity

“There is an important call to action for Asian Americans—that is to critically and emphatically challenge the history of anti-black ideas we have come to believe in, and then shed them. Once we recognize that the model minority myth has intentionally and thoughtfully bamboozled us, the renewed power of choice instantly awaits, and we are empowered to arch our misguidance against each other toward a solidarity in our fight against the true common threat: white supremacy.”

- Speaking at a Senate press conference on student loan reform.

I joined several Senators to discuss the impacts of their new proposed legislation. The Senate-proposed legislation will allow students to refinance their student loans. - Speaking on Al Jazeera America on the student debt crisis.

I was interviewed on Al Jazeera America to share my personal story and experience with student debt. My story was a part of a larger segment on the student debt crisis in the U.S.

Clients